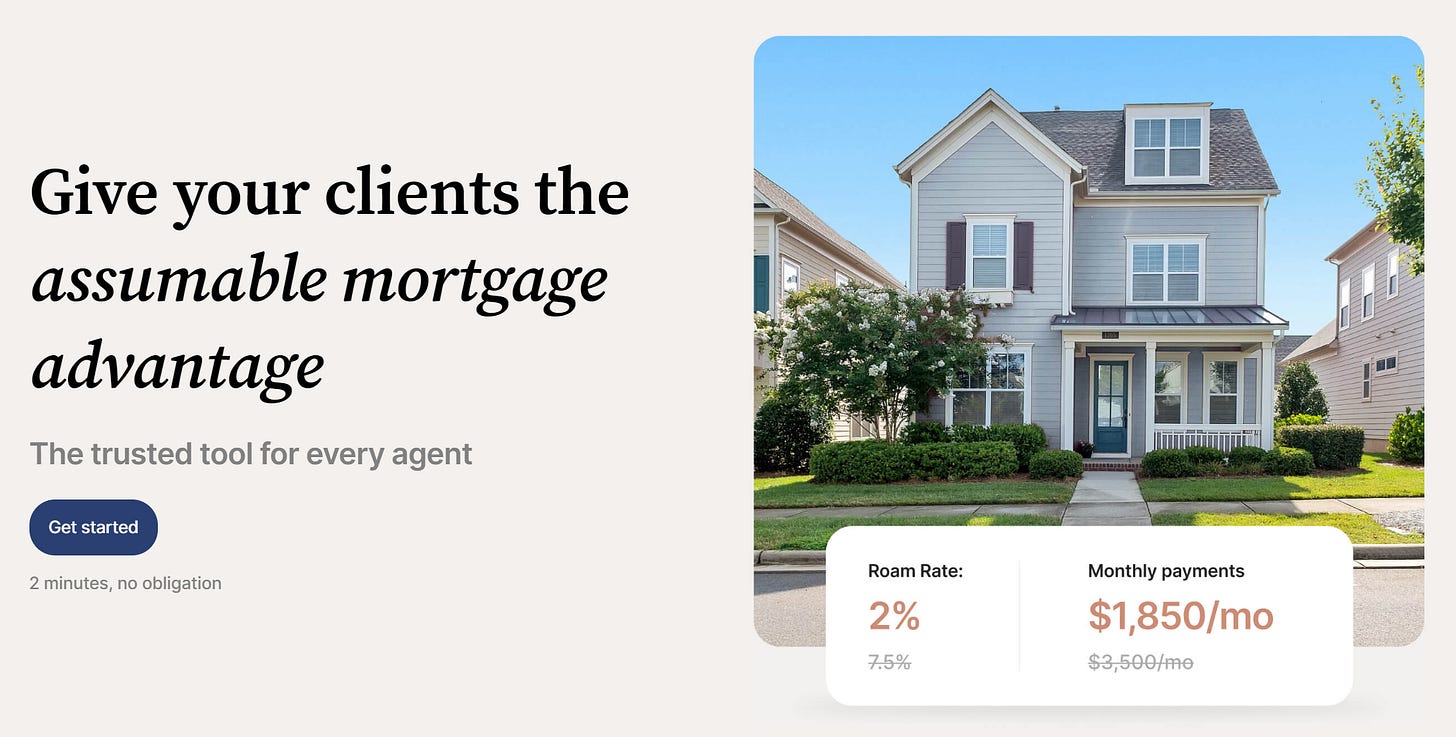

Roam is a platform that helps sellers and buyers transact on assumable mortgage properties.

Attaining Homeownership

Their goal? To bring affordable homeownership in the hands of a million Americans by 2030.

Prospective homeowners are holding off on buying homes due to rising interest rates and housing costs. If you didn’t catch the low interest rate wave in 2020 and 2021, you’re likely renting and waiting ‘til the rates drop. If you did buy in 2020 and 2021, you’re likely unwilling to sell and let go of your low rate.

Roam is a new start-up hoping to help Americans navigate the assumable mortgage market. They list eligible properties and help coordinate the transaction between the buyer and seller. They are not a real estate agent or lender. They’re a platform that connects interested parties and facilitates the complicated process of taking over an existing mortgage.

Wait, how can I just take someone’s mortgage?

Assumable mortgages have been around for decades. Rather than take out a new conventional loan at historic interest rate highs, homeowners can save a substantial amount of money by assuming the seller’s lower rate mortgage.

However, only a limited amount of mortgages are assumable. Government backed mortgages, like the FHA (Federal Housing Authority) and VA Loans are eligible. Typically, conventional mortgages don’t qualify due to a “due-on-sale” clause, which requires the seller to pay the mortgage in full before selling.

Assuming a mortgage isn’t popular. Due to requirements, long timelines, and unawareness, people don’t consider this an option. Roam entered the real estate chat to provide transparency around the process.

According to Roam, there were 6,400 mortgage assumptions in 2023, more than double the amount in 2022. They’re growing in popularity, especially as eager buyers and sellers navigate the turbulent real estate environment.

Who is this for?

Sellers who are patient and willing to navigate the red tape of assumable mortgages. Buyers who have substantial cash to pay back the seller’s current equity. And agents who are looking to list assumable mortgages to a targeted audience.

Currently, it’s hard to figure out which listings online have an assumable mortgage. Popular sites like Zillow and Redfin don’t really advertise them. Even if they do, agents aren’t incentivized to stick around to help buyers or sellers navigate the lengthy process.

Roam wants to ease to this process for eager homebuyers. Time will tell how they fare in today’s market.